Most small to midsize businesses that want a cloud-based solution. Both QuickBooks Online and QuickBooks Desktop are capable programs with strong accounting features. Both QuickBooks Online and QuickBooks Pro and Premier have notoriously poor customer support (QuickBooks Enterprise support has better priority support). In contrast, QuickBooks Desktop offers hardly any payment gateways, making it difficult for the modern merchant to accept online invoice payments easily.

QuickBooks Online Advanced Pricing

Meanwhile, Essentials gives you access to more than 40 reports, including those you can generate in Simple Start. Its additional reports include accounts payable (A/P) and A/R aging, transaction lists by customer, expenses by vendor, uninvoiced charges, unpaid bills, and expenses by supplier summaries. You can drill down to a list of your outstanding invoices instead of only the total outstanding. QuickBooks Online is our overall best small business accounting software.

Final Verdict: Is QuickBooks Online Worth It?

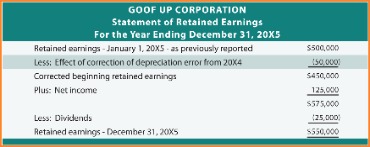

It’s packed with features including expense tracking, invoicing and mileage tracking. Although many customers like QuickBooks Online, there are a few significant shortcomings to income statement the software. Frequent complaints about the software running slow have been addressed, but other problems still exist, like poor customer support and bugs on the mobile app.

Enterprise Software Bundle

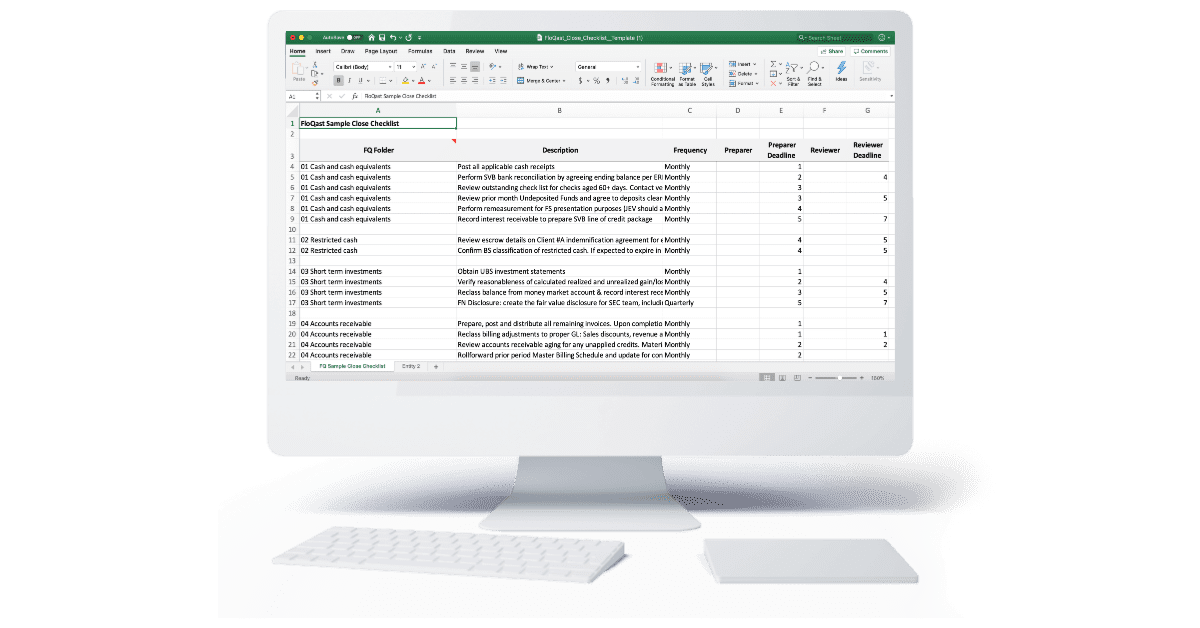

Once the data is finalized in Excel, you can easily post it back to QuickBooks Online Advanced. Batch expensing allows you to record and categorize multiple expenses at once instead of entering them individually. This is especially useful if you have many expenses to record, such as business travel expenses, office supplies, and equipment purchases. You can upload expense receipts in bulk, categorize them according to the appropriate expense account, and then submit them for approval. With Essentials, you can track your unpaid bills easily and pay them directly within QuickBooks. You just need to select the bills you want to pay from the Pay Bills window, place a checkmark next to the bills, and then select Save or Save and Print.

- QuickBooks Online Payroll costs between $45-$125/month plus $6-$10/month per employee, depending on which of the three QBO Payroll pricing plans you choose.

- Businesses with inventory will likely get the most benefit from QuickBooks Plus.

- You can automatically notify customers when their payments have been received and you can route invoices through pre-set approval flows.

- QuickBooks Payments doesn’t offer support for businesses accepting transactions outside of normal working hours.

Unfortunately, pricing is no longer disclosed and you will need to contact QuickBooks Sales for more pricing details. At the time of our last review, pricing started at $349.99/year for a single user. While QuickBooks Online boasts many of the features you’ll find with Desktop, some of its features, such as inventory management, aren’t quite as advanced. Additionally, you won’t find the industry-specific features and reports that you’ll get if you sign up for Desktop.

It seems complicated, but QuickBooks Online walks you through the entire process. QuickBooks Desktop has a more dated user interface than some cloud-based products and requires prior accounting knowledge to get the most out of the product. While QuickBooks products work for many businesses, they aren’t the best choice for all businesses. If neither of these options seems to be the right fit or you’re just exploring your options, make sure to check out our list of the best accounting software for small businesses for more great options.

No, it is relatively easy to use, although corrections can be more challenging. However, so if you work with a professional accountant, they will likely have an in-depth understanding of the platform and can guide you through its functions. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website.

And the fact that the brand has survived this long despite the very volatile internet landscape is a testament to the value they’ve brought to their clientele. This kind of accounting simplicity is often best for freelancers and soloprenuers in B2B office labor verticals like marketing, sales, IT — you get the idea. These individuals don’t have much need to track expenses, but they do need something better than a static spreadsheet to keep track of all of their income, and that’s what FreshBooks provides. Another notable difference is QuickBooks Online offers a Self-Employed version for $15 per month, which is not available with QuickBooks Desktop. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

Additionally, there are numerous time-saving automations, such as recurring invoices and auto-scheduling. QuickBooks users can also easily apply for funding through the built-in lending platform QuickBooks Capital. Spreadsheets can be a useful tool for historical tracking—but they have limited functionality when it comes to syncing data and automating processes, making them prone to errors. QuickBooks Online automatically syncs with connected bank and credit card accounts and auto-categorizes expenses to help small business owners save time.

These hours can be added by the manager manually, though the employee in question can also be given permission to add their hours themselves. You can create an unlimited number of invoices and estimates, as https://www.quick-bookkeeping.net/ well as tracking your expenses, managing business contacts — you can also manage up to 1,099 contractors. You can bring live bank feeds into your account and access a range of third-party integrations.

Payment gateways allow you to accept payments from your customers. Common payment processing options include PayPal, Stripe, Square, and Authorize.Net. QuickBooks Online https://www.accountingcoaching.online/what-are-different-types-of-ledgers/ offers around 25 payment processors, or you can use QuickBooks Payments. QuickBooks Online payroll costs between $45-$125/month plus $6-$10/month per employee.

The higher your plan tier, the more reports and users you can add, although it’s important to understand concurrent users are each sold separately. The two versions are independent of each other, which means the data you enter on Desktop doesn’t sync to the Online version and vice-versa. Those who want to take their accounting on the go will appreciate the mobile app. It brings most of the features of the online platform, plus it enables mileage tracking and receipt capture for quick and convenient recordkeeping. QuickBooks Online Plus helps you manage and view all parts of your business, all in one place.

Advanced is slightly better than Plus and the other QuickBooks Online plans in A/P and A/R because of its batch invoicing and expense management features. Batch invoicing allows you to create multiple invoices at once rather than creating them one at a time. This can be useful if you have many customers who need to be invoiced for the same products or services. You just need to create a single invoice template and then apply it to all the customers who require the same invoice. Simple Start is a good starting point for most small businesses, especially those that don’t need to enter bills, track billable hours, and manage projects and inventory.